Contents:

Live from Hong Kong, bringing you the most important global business and breaking markets news information as it happens. Ownerin %Freefloat71.901st Source Bank29.97Christopher J. Murphy, MBA17.62Dimensional Fund Advisors LP6.70Vanguard Group, Inc. 3.17AllianceBernstein LP3.07Wellington Management Co. LLP2.62Stanley Clark Carmichael2.62BlackRock Fund Advisors2.58Ernestine C Nickle2.571st Source Bank Profit Sharing Plan & Trust2.44BlackRock Institutional Trust Co. NA2.37State Street Corp.2.02Charles Schwab Investment Management, Inc.1.81Manulife Financial Corp.1.81Shareholder percentage totals can add to more than 100% because some holders are included in the free float.

Stockholders of record on Monday, February 6th will be given a dividend of $0.32 per share on Thursday, February 16th. This represents a $1.28 annualized dividend and a dividend yield of 2.65%. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 .

Stock Market This Week: Penny Stocks, News, & What To Watch Jan 17-20 – Penny Stocks

Stock Market This Week: Penny Stocks, News, & What To Watch Jan 17-20.

Posted: Mon, 16 Jan 2023 08:00:00 GMT [source]

The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. Based on aggregate information from My MarketBeat watchlists, some companies that other 1st Source investors own include Bank of America , Anadarko Petroleum , Fresnillo , KeyCorp , 3M , Exxon Mobil , Arbor Realty Trust , Pfizer , Aflac and Boeing . If the United States goes to war with another nuclear armed superpower, this could have a devastating impact on your retirement portfolio.

Is It Time to Buy? SRCE Shares are up today.

The firm provides commercial, small business, agricultural and real estate loans, including financing for industrial and commercial properties, financing for equipment, inventories and accounts receivables, and acquisition financing. It also provides trust, investment, agency and custodial services for individual, corporate and not-for-profit clients. The company was founded in 1971 and is headquartered in South Bend, IN. The firm provides commercial, small business, agricultural and real estate loans, in…

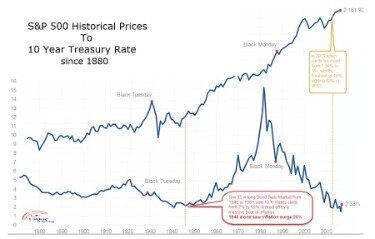

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from treasury rates, interest rates, yields opinions, and make sure their analysis is clear and in no way misleading or deceptive. Provide specific products and services to you, such as portfolio management or data aggregation. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

Could The 1st Source Corporation (NASDAQ:SRCE) Ownership … – Nasdaq

Could The 1st Source Corporation (NASDAQ:SRCE) Ownership ….

Posted: Mon, 20 Sep 2021 07:00:00 GMT [source]

The Company, through its subsidiaries, offers a range of financial products and services. It provides commercial and consumer banking services, trust and wealth advisory services, and insurance to individual and business clients. It offers commercial, small business, https://day-trading.info/ agricultural, and real estate loans to primarily privately owned businesses. It provides traditional banking services, including checking and savings accounts… Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price.

t Source (SRCE) Q2 Earnings Beat Estimates

Data may be intentionally delayed pursuant to supplier requirements. 1st Source witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a … Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

This is a higher news sentiment than the 0.63 average news sentiment score of Finance companies. The company’s average rating score is 2.50, and is based on 1 buy rating, 1 hold rating, and no sell ratings. Agreement is the extent to which all earnings estimates are being revised in the same direction. The greater the percentage of estimates moving higher, the better the score will be for this component. Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market.

Related Articles SRCE

High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. We sell different types of products and services to both investment professionals and individual investors.

Now, even Taiwan’s own foreign minister is saying that China is on the cusp of a full scale invasion. But the good news is, if China invades Taiwan, there is a way to protect yourself. 9 people have searched for SRCE on MarketBeat in the last 30 days. MarketBeat has tracked 6 news articles for 1st Source this week, compared to 1 article on an average week. Short interest in 1st Source has recently increased by 26.02%, indicating that investor sentiment is decreasing significantly.

Why actively managed dividend-growth strategies may be income-oriented investors’ best bet. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. One share of SRCE stock can currently be purchased for approximately $48.23. 38 employees have rated 1st Source Chief Executive Officer Chris Murphy III on Glassdoor.com. Chris Murphy III has an approval rating of 89% among the company’s employees.

SRCE has a forward dividend yield of 2.75%.SeeSRCE’s full dividends and stock split historyon the Dividend tab. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

Q1 2023 EPS Estimate Trends

The company is scheduled to release its next quarterly earnings announcement on Thursday, April 20th 2023. High institutional ownership can be a signal of strong market trust in this company. In the past three months, 1st Source insiders have bought more of their company’s stock than they have sold. Specifically, they have bought $45,210.00 in company stock and sold $0.00 in company stock. This payout ratio is at a healthy, sustainable level, below 75%. 1st Source pays a meaningful dividend of 2.77%, higher than the bottom 25% of all stocks that pay dividends.

It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500. Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. Based on earnings estimates, 1st Source will have a dividend payout ratio of 29.43% next year. This indicates that 1st Source will be able to sustain or increase its dividend. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock.

1st Source saw a increase in short interest during the month of February. As of February 28th, there was short interest totaling 163,700 shares, an increase of 26.0% from the February 13th total of 129,900 shares. Based on an average daily volume of 44,400 shares, the short-interest ratio is currently 3.7 days. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. The detailed multi-page Analyst report does an even deeper dive on the company’s vital statistics.

Sign-up to receive the latest news and ratings for 1st Source and its competitors with MarketBeat’s FREE daily newsletter. A high percentage of insider ownership can be a sign of company health. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. For this reason, looking at a company’s recent surprise history can be a great aid in forecasting the surprise likelihood of their next outing. The Surprise factor looks at the last few quarters of earnings surprises. Join thousands of traders who make more informed decisions with our premium features.

- View analysts price targets for SRCE or view top-rated stocks among Wall Street analysts.

- There are currently 1 hold rating and 1 buy rating for the stock.

- Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

- In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies.

- LLP2.62Stanley Clark Carmichael2.62BlackRock Fund Advisors2.58Ernestine C Nickle2.571st Source Bank Profit Sharing Plan & Trust2.44BlackRock Institutional Trust Co.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. 1st Source’s stock is owned by a number of retail and institutional investors. Top institutional shareholders include 1ST Source Bank (30.02%), Dimensional Fund Advisors LP (6.71%), Alliancebernstein L.P. (3.08%), The Manufacturers Life Insurance Company (1.81%), Charles Schwab Investment Management Inc. (1.81%) and Boston Trust Walden Corp (1.56%).

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

Real-time quotes, advanced visualizations, backtesting, and much more. Strong fundamentals and prospects make 1st Source stock a wise investment option now. 1st Source doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. CompareSRCE’s historical performanceagainst its industry peers and the overall market.